Valuation is an art.

Assumptions are needed to perform any type of analysis as the whole topic of stock valuation is forward looking. Throughout these valuation exercises, it’s important to understand that the final stock value will vary based on the assumption of scenarios. Instead of trying to pinpoint one number, the science behind valuing stocks is to come up with a range of values. By doing so, it helps you to think about the downside as well as the upside possibilities.

I have written about DCF valuation for Gadang last few days. The article can be access at link below:

http://www.trvanalyzer.com/discounted-cash-flow-valuation-for-gadang-klse9261

I have receive some mixed comments on the article. Some commented that certain one off items should be left out in the valuation. Some also commented that Gadang should not be valued using DCF as it is contract based company.

Yes, those comment are right. I did mentioned in the article that Gadang as a construction company do have lumpy cash flow. Cash is received as they progressively billed for their project.

Now lets us look at another valuation method which is based on its earning and growth.

Benjamin Graham’s Formula to Value a Stock

The Benjamin Graham formula is an intrinsic value formula proposed by investor and professor, Benjamin Graham, often referred to as the “father of value investing”. Published in his book, The Intelligent Investor, Graham devised the formula for investors to be able to quickly determine how rationally priced their stocks were.

Original Formula

In The Intelligent Investor, Benjamin Graham describes a formula he used to value stocks. He disregarded complicated calculations and kept his formula simple. In his words: “Our study of the various methods has led us to suggest a foreshortened and quite simple formula for the evaluation of growth stocks, which is intended to produce figures fairly close to those resulting from the more refined mathematical calculations.”

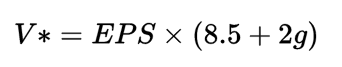

The formula as described by Graham in the 1962 edition of Security Analysis, is as follows:

V = Intrinsic Value

EPS = Trailing Twelve Months Earnings Per Share

8.5 = P/E base for a no-growth company

g = reasonably expected 7 to 10 year growth rate

Where the expected annual growth rate “should be that expected over the next seven to ten years.” Graham’s formula took no account of prevailing interest rates.

Revised formula

He revised his formula in 1974 (Benjamin Graham, “The Decade 1965-1974: Its significance for Financial Analysts,” The Renaissance of Value) as follows:

Graham suggested a straightforward practical tool for evaluating a stock’s intrinsic value. His model represents a down-to-earth valuation approach that focuses on the key market-related and company-specific variables.

The Graham formula proposes to calculate a company’s intrinsic value V* as:

V: Intrinsic Value

EPS: the company’s last 12-month earnings per share

8.5: the constant represents the appropriate P-E ratio for a no-growth company

g: the company’s long-term earnings growth estimate

4.4: the average yield of high-grade corporate bonds

Y: the current yield on 20 year AAA corporate bonds.

Let’s go through the few assumptions in Graham formula and perform the valuation for GADANG.

Intrinsic value shouldn’t be calculated based on a single 12 month period which is why I have the EPS automatically adjusted to a normalized number. EPS is never really a good number on its own as it is highly prone to manipulation with modern accounting methods.

TTM Gadang EPS at 0.407 with diluted EPS at 0.36. To be conservative we use a normalized EPS of 0.267. The normalized EPS is calculated from TTM and latest 3 financial years.

2. Growth Rate

One of the way to estimate the growth rate is to look at the growth rate of several matrix such as revenue, gross profit, net profit, operating cash flow and free cash flow.

By looking at 10 year histories of the companies, we can see the companies ability to generate growth. The past is only a indication of the future. There is no certainty that it will perform in this way, yet learning from the past will help in determining the future.

Gadang’s revenue grow at 13.7% CAGR for the last 10 years with net profit grow at 10.7% for the same period. Other matrices also showing very decent growth rate. To be more on the conservative side, we will take 10% growth for Gadang in the Graham formula calculation.

3. Other Adjustments

We adjust the no growth PE to 7.0. You can change 8.5 to whatever you feel is the correct PE for a no growth company. Depending on your conservativeness, anything between 7 and 8.5 should be fine.

The “2 x G” however, is quite aggressive. So we also reduced the multiplier to 1.5 instead of 2.

After the adjustment the final formula will look like this.

Calculation for Graham formula

Click to enlarge. Diagram showing Benjamin Graham Calculation for Gadang.

Summary

Benjamin Graham’s intrinsic value formula isn’t perfect. There are several flaws in the model but for the average person who wants to try and put together a diversified portfolio of high quality blue chip stocks that will grow over time without major wipeout risk, it does have utility.

What are the shortfalls? It doesn’t account for capital intensity, for one. That is important.

But it’s still useful in serving as a safety check to help you avoid using stocks as a lottery ticket and overpaying for businesses.

[…] have previously written two articles on DCF valuation and Benjamin Graham’s Formula valuation for […]