The following notes are reproduced from the presentation by Faridah Ali, Head of Retail Business and Q&A from fellow shareholders.

Financials

Revenue increase 36% due to higher oil price and higher sales volume.

Total sales volume increase by 9% from 32mil barrels to 34.9mil barrels.

The management mentioned that the breakdown of earnings for each segment, i.e. refinery, retail and commercial varies each year depending on the contribution of the refinery. From the slides below, the company provided the break down for the marketing and refining segment.

Net income increased 70% due to higher refinery margin and higher other income (RM 65.6mil from compulsory land acquisition by the government).

In 2018, estimated CAPEX is RM340mil from which about RM160mil for retail while the rest are for refinery. Total CAPEX estimated to upgrade the refinery to meet the EURO5 requirement by 2020 is estimated to be about RM600mil which will be funded by internally generated fund and debt.

View full financial for PETRONM from TRV STOCK ANALYZER here:

Port Dickson Refinery (PDR)

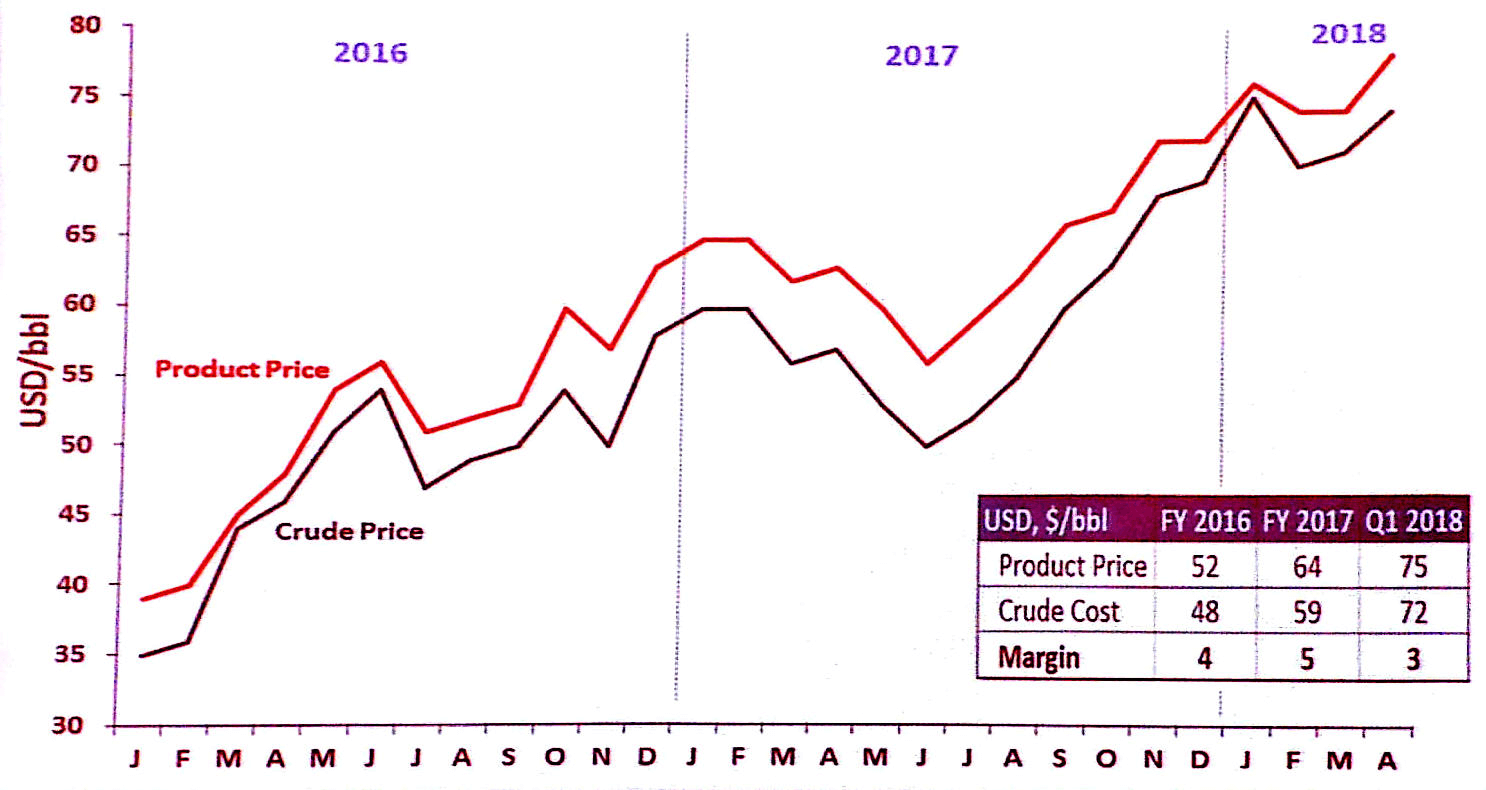

In 2017, crude producer cut back production and this lead to 23% increase in crude oil price. The price of the finished product increase at a faster rate resulting in higher refining margin.

In Q1 2018, crude oil price continues to rise due to higher demand and tension in the middle east. However, the refining margin is lower.

Refining margin for PETRON is provided in the slides below:

Plant utilization rate in 2017 is 57% with average production of 50,000 barrel per day. There will be a scheduled plant shut down for 40 days in Sept 2018.

There is no plan to increase the refinery production capacity at the moment.

Refinery profitability depends on the refinery margins and optimization of the refinery.

Retail business

Retail business continue to grow by network expansion and effective marketing strategy. Total retail market share grew from 19% to 20.5% in Q1 2018.

Petron group established a total of 40 new stations in 2017. 14 new stations are under Petron Malaysia Refining & Marketing Bhd (PMRMB) while 26 new stations under the sister company – Petron Fuel International (PFI). Currently there are 18 new stations that are completed and will be open by end of the year. Target to have 50 new stations for 2018.

There may be 2 potential divestment due to compulsory acquisition by government in this year. First is from a highway project in Tanah Merah, Kelantan while the second divestment is related to LRT3 project in Bukit Tinggi, Klang.

The recent government action to freeze the fuel price has no impact on the margin for Petron. The current Automatic Pricing Mechanism is still in place. However, with higher fuel subsidy due to rising of fuel price, it may affect the company’s cash flow due to subsidy receivables from the government.

Currently Petron owns more than 600 petrol stations, in which 320 stations are own under PMRMB (the listed entities) while the balance is owned under PFI (wholly owned by Petron Corp, Philippines). About 12% of total market share belongs to PMRMB’s stations while the balance belongs to PFI.

The decision on petrol station to be parked under which company is based on the terminal servicing the petrol station.

Petrol stations drawing fuel from terminal such as Kuantan and Pasir Gudang which is PMRMB affiliate terminals will be parked under PFI.

This structure was inherited from Exxon-Mobil. PMRMB was Esso Malaysia which is under Exxon Corporation. While PFI was Mobil Petroleum International.

Commercial business

Higher demand for industrial fuel and LPG contributed to higher sales. More new key account mainly in aviation, manufacturing and power plant.

Sales volume in aviation grew with increasing demand in air travel. In 2017, Petron secured 5 new accounts to fuel domestic and international flights in KLIA and KLIA2. These new accounts are Xiamen Airlines, Qantas, Tiger and Scoot which contribute about 4% to the revenue.

View full financial for PETRONM from TRV STOCK ANALYZER here:

Leave A Comment