“Quality” tab aim to perform a quality check for the stocks.

This tab can be broken down into 6 parts to look at various aspect of a stock.

Part 1 : Earnings Quality Check with Accrual Analysis

Part 2 : Sloan Ratio

Part 3 : Piotroski F Scores

Part 4 : DuPont Analysis

Part 5 : Altman Z Score

Part 6 : The Beneish Model – M Score Variables

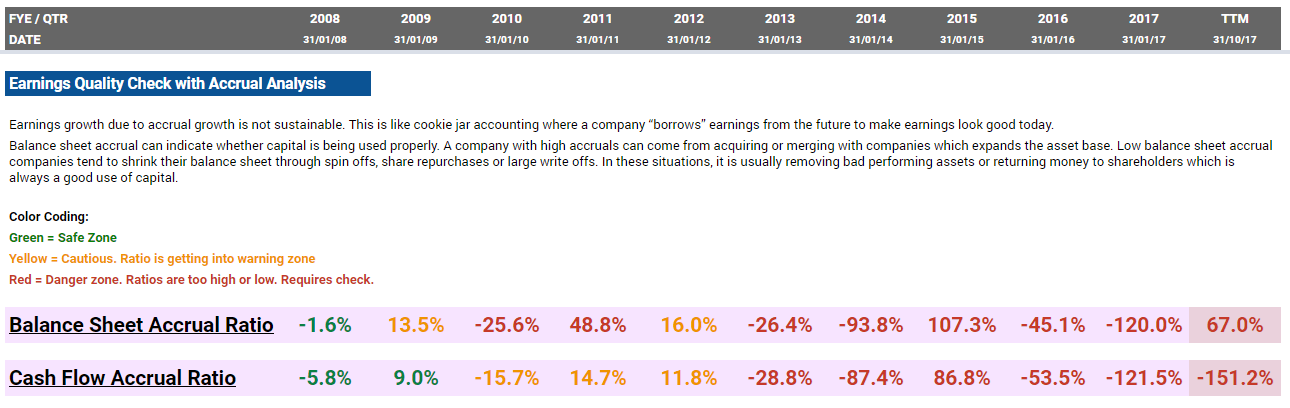

Earnings Quality Check with Accrual Analysis

Accruals are accounting adjustments for revenues that have been earned and expenses that have been incurred but are not yet recorded in the accounts. While accruals are necessarily to get an accurate reflection of the company’s performance, they lend themselves to management discretion and possibly manipulation of earnings.

Management is under constant pressure to achieve targets and will try to speed up revenue recognition or delay expenses if the next results is below expectations. Conversely, management may actually slow down revenue recognition or pay for future expenses in order to smooth earnings into upcoming quarters.

If management is increasing the amount of overall earnings, not by actual cash earnings, but by accrual accounting manipulation then the possibility of a reduction in earnings is high. Conversely, a company with low or declining aggregate accruals should have more persistent earnings and higher quality.

Accrual manipulation leads to significant security mispricing which is very likely to lead to a correction in the future. You can read more about this in the paper Accrual Reliability, Earnings Persistence and Stock Prices by Richardson, Sloan, Soliman and Tuna.

The authors recommend to monitor and compare accruals levels and created 2 ratios for this:

- Balance Sheet Accrual Ratio

- Cash Flow Accrual Ratio

The Formula: Balance Sheet and Cash Flow Accrual Ratio

First calculate Net Operating Assets:

Next, subtract last period’s NOA from the current NOA figure to arrive at Balance Sheet Accruals.

The Balance Sheet Accruals Ratio is determined by dividing that number by the average accruals.

The procedure is similar when calculating Cash Flow Aggregate Accruals, as shown below.

Example of a stock with good accrual ratio:

Example of a stock with poor accrual ratio:

If the ratio is between -10% and 10%, the company is in the safe zone and there is no funny business with accruals.

If the ratio is less than between -25% and -10% on the negative side, and between 10% and 25% on the positive side, this is a warning stage of accrual build up.

If the ratio is less than -25% or greater than 25%, and this ratio is consistent over several quarters or even years, be careful. Earnings are highly likely to be made up of accruals.

An increase in earnings accompanied by an increase in the accruals ratios should raise a red flag. The same is true when the company posts above industry-average growth combined with above-average growth of the BS Accrual Ratio.

![[User Guide] TRV Stock Analyzer Overview](https://trvanalyzer.com/wp-content/uploads/2017/09/Tutorial-Header-Overview-Tabs-500x383.png)

![[User Guide] “Home” Tab](https://trvanalyzer.com/wp-content/uploads/2017/09/Tutorial-Header-Home-Tab-500x383.png)

![[User Guide] “F-Dashboard” Tab](https://trvanalyzer.com/wp-content/uploads/2017/09/Tutorial-Header-F-Dashboard-500x383.png)

Leave A Comment