Benjamin Graham — also known as The Dean of Wall Street and The Father of Value Investing — was a scholar and financial analyst who mentored legendary investors such as Warren Buffett, William J. Ruane, Irving Kahn and Walter J. Schloss.

Warren Buffett once gave a talk explaining how Graham’s record of creating exceptional investors (such as Buffett himself) is unquestionable, and how Graham’s principles are everlasting. The talk is now called The Superinvestors of Graham-and-Doddsville.

Buffett describes Graham’s book The Intelligent Investor (in its preface) as “by far the best book about investing ever written”.

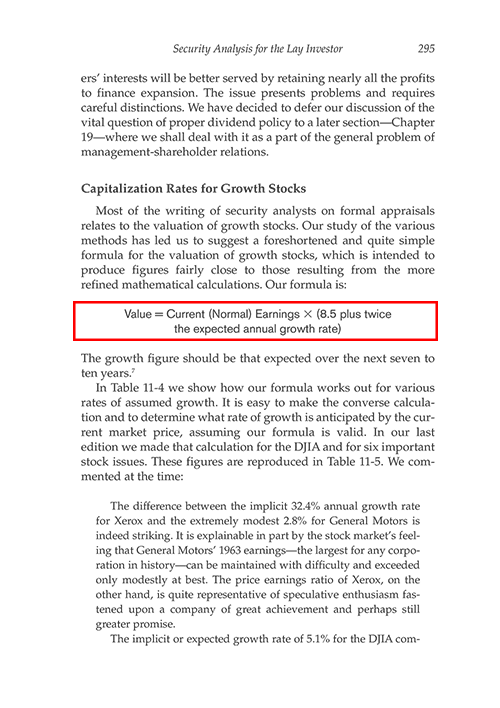

Original Benjamin Graham Growth Formula

The initial formula as described by Graham in The Intelligent Investor Ed 2006 (Page 295) was as follows:

where V is the intrinsic value, EPS is the trailing 12 month EPS, 8.5 is the PE ratio of a stock with 0% growth and g being the growth rate for the next 7-10 years

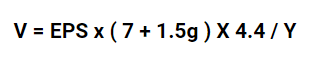

However, this formula was later revised as Graham included a required rate of return.

The formula is essentially the same except the number 4.4 is what Graham determined to be his minimum required rate of return. At the time of around 1962 when Graham was publicizing his works, the risk free interest rate was 4.4% but to adjust to the present, we divide this number by today’s AAA corporate bond rate, represented by Y in the formula above.

Adjust Earnings Per Share in the Graham Formula

One of the main “ingredient” in this formula is EPS. However, intrinsic value shouldn’t be calculated based on a single 12-month period which is why the EPS has to be automatically adjusted to a normalized number. In the analyzer, the EPS is calculated based on the MEDIAN of last 3 financial years and TTM.

EPS is never really a good number to begin with on its own as it is highly prone to manipulation with modern accounting methods. Another reason why you have to always normalize EPS is because management will never understate earnings on purpose. While companies may follow accounting procedures which inflates earnings, they will never go out of their way to make it lower than it is.

Another variation of the formula will use the projected EPS but unless it is a pure growth stock with exponential growth like characteristics, the stock value will become absurdly high.

Adjusting No Growth PE

Both the original and later modified formula uses 8.5 as a no growth PE. However, you can change 8.5 to whatever you feel is the correct PE for a no growth company. Depending on your conservativeness, anything between 7 and 8.5 should be fine.

Similar to the Vitaliy Katsenelson’s Absolute PE Model, for a small caps stock you may use 7 (14.2%) while big cap uses 8.5 (11.8%). For bigger cap stock and stable stock, the market usually willing to pay a higher PE.

The default no growth PE used in the analyzer is 7.

Adjusting Growth Rate

The drawback of the Benjamin Graham formula is that growth is a big element of the overall valuation.

For the actual growth rate, if possible, you could just use the analyst or company 5yr predictions. However, these figures are hard to come by and hard to be verified. In the analyzer, we have use a median growth rate based on a few important financial figures. This figure is usually more conservative. You may check the growth rate calculation in the “Growth Rate” tab.

The “2 x G” however, is quite aggressive. So we have reduced the multiplier to 1.5 instead of 2.

Corporate Bond Rate

You may check the current bond rate from the link in the analyzer.

In general, the higher the bond rate, the lower the stock valuation.

Final Adjusted Benjamin Graham Formula

So by making the adjustments, the new formula is now:

Benjamin Graham Formula with TRV Analyzer

Above is the calculation for Benjamin Graham Formula for ORNA. Everything is set to default with only manual key in of the bond rate. You have the option to change each parameter in the formula.

Summary

Benjamin Graham’s intrinsic value formula isn’t perfect. There are several flaws in the model but for the average person who wants to try and put together a diversified portfolio of high quality blue chip stocks that will grow over time without major wipeout risk, it does have utility.

What are the shortfalls? It doesn’t account for capital intensity, for one. That is important.

But it’s still useful in serving as a safety check to help you avoid using stocks as a lottery ticket and overpaying for businesses. It is also a good valuation method especially when you use it along with other valuation models.

![[User Guide] TRV Stock Analyzer Overview](https://trvanalyzer.com/wp-content/uploads/2017/09/Tutorial-Header-Overview-Tabs-500x383.png)

![[User Guide] “Home” Tab](https://trvanalyzer.com/wp-content/uploads/2017/09/Tutorial-Header-Home-Tab-500x383.png)

![[User Guide] “F-Dashboard” Tab](https://trvanalyzer.com/wp-content/uploads/2017/09/Tutorial-Header-F-Dashboard-500x383.png)

Leave A Comment